Introduction To Crowdfunding

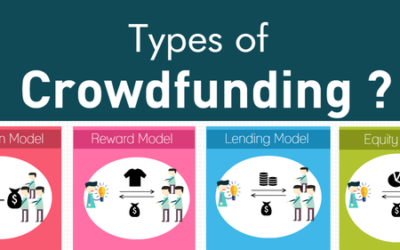

Crowdfunding is a new form of capital aggregation that using the internet to build an excited and engaged crowd of followers that buy into a shared vision of a project. Crowdfunding at its essence is a large group of people funding a large project with small dollar amounts. The major difference in crowdfunding is how these small dollar amounts are collected. There are basically four different types of crowdfunding. They are (1) donation, (2) reward, (3) equity, and (4) debt.

Donation Crowdfunding – the crowd gives money or some other resource because they want to support a cause. The crowd gives money and gets nothing in return, other than the good feeling that comes with knowing they have helped someone in need. This is the most common form utilized by charities. GoFundMe is the most popular platform where donation crowdfunding occurs, but this is only one form of crowdfunding and the one most people are most familiar with. Many people have participated in a donation crowdfunding campaign on GoFundMe to support a disaster or to support someone during a funnel.

Reward Crowdfunding – Reward or Seed crowdfunding is another type of donation crowdfunding where a founder or creator has a concept or product that has a business value and the goal is to pre-sell the product or concept. For example, a person creates a new case for cell phones and pre-sell the case to the public for a discounted amount using a platform such as Kickstarter or Indiegogo using digital marketing. Individuals forming the crowd pre-purchase the product online using the crowdfunding platform. This product in exchange for the “reward,” typically the product or service that that particular company produces or provides. Reward-based crowdfunding has been made popular by crowdfunding sites such as Kickstarter and Indiegogo and has raised billions of dollars and added many jobs to the economy. Rewards or seed crowdfunding is a great way for a business concept that requires market validation and proof of concept. In the Black Crowdfunding space, fund black founders is the leading rewards or seed crowdfunding platform.

Understanding Regulation Crowdfunding – Regulation Crowdfunding provides an exemption from the registration requirements for securities-based crowdfunding allowing companies to offer and sell up to $5 million of their securities without having to register the offering with the SEC. With Regulation Crowdfunding, the general public now has the opportunity to participate in the early capital formation of start-up and early-stage businesses. Anyone can invest in a Regulation Crowdfunding offering. Because of the risks involved with this type of investing, however, you are limited in how much you can invest during any 12-month period in these transactions. The limitation on how much you can invest depends on your net worth and annual income.

Investment Crowdfunding – members of the crowd become part-owners of the company by going to a Regulation Crowdfunding platform that is SEC and FINRA regulated because there is a sale of securities for raising funds. In other words, the company sells some or all of its shares to the members of the crowd — the public. The new crowd investors, as equity owners of the company, invest with the goal of realizing a return on its investment and, assuming the company performs well, receives a share of the profits, in the form of a dividend or distribution with the ability for an exit event such as the company being sold or going public through an IPO. Buy the Black is the leading Black-owned Regulation Crowdfunding platform with at least two new platforms being formed the 10K Project and Crowd Wall Street.

Debt crowdfunding – also known as peer-to-peer lending or P2P, is the final type of crowdfunding that we will explore in this blog post. In this type of crowdfunding, the company raising money does not sell shares but instead borrows money from the crowd. The individuals lending the money receive the company’s legally binding commitment to repay the loan at certain time intervals and at a certain interest rate. It is like the crowd becomes the bank providing loans to businesses in exchange for interest payments. The leading debt platform in the Black crowdfunding space is EnrichHer.

The Crowdfunding Transformation

Initially, crowdfunding was an effective vehicle for people with creative projects or great causes to raise money and fund their goals. The original crowdfunding sites like Kickstarter and Indiegogo were campaign-centered donation or rewards models that created a transactional relationship between the supporters and project owners.

Investment Crowdfunding is the natural evolution of this donations and rewards-based model, by adding an element of powerful social networking and community building that allows entrepreneurs, small business owners, investors, and industry leaders the opportunity to form lasting relationships with funders and knowledge sources through crowdsourcing. Investment Crowdfunding’s purpose is to create high value and lasting relationships with a network of supporters that help grow a business throughout its life cycle.

With the passing of Title III, the value of growing your investor community via social networking and crowdsourcing has never been more important than right now. Equity Crowdfunding lets you take the power of the crowd and make it meaningful for your business. If you want to learn more about how to use crowdfunding as an alternative funding path for your small business or startup please visit Crowd-Max.com